Disaster Recovery: Defining RTO & RPO for Executives

There is a dangerous conversation that happens in every company.

The CEO asks the CTO: "Are our backups working?"

The CTO says: "Yes."

They both leave the room happy. But they are talking about two completely different things.

- The CTO means: "We have a cron job that dumps the database to S3 every night at midnight."

- The CEO means: "If the server explodes at 4:00 PM, I assume we lose zero data and are back online instantly."

When the inevitable crash happens, this misalignment turns into a career-ending event.

As a technical leader, your job is not just to "do backups." It is to negotiate the price of downtime. You must define two acronyms that translate technical risk into dollars: RTO and RPO.

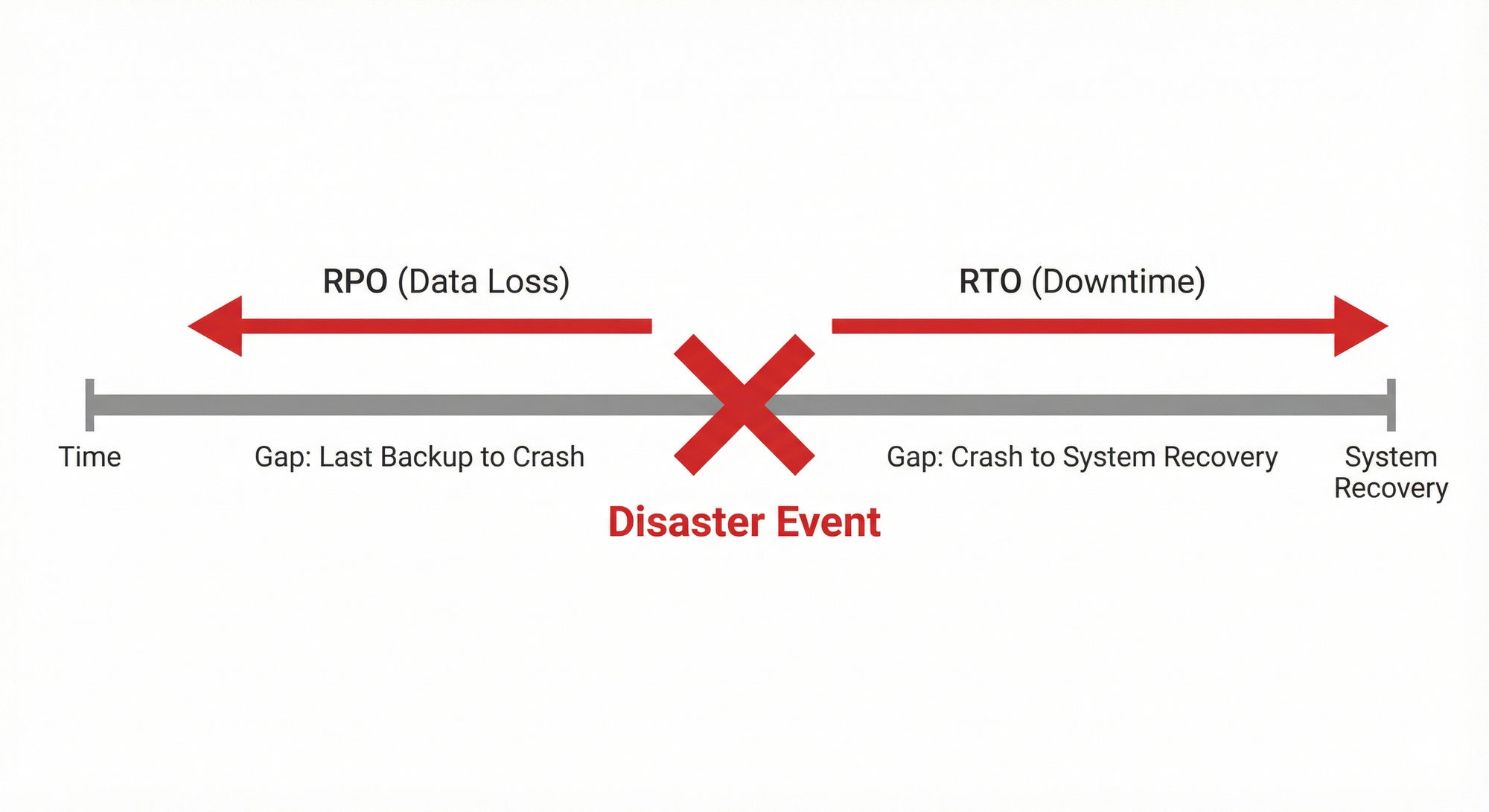

1. The Definitions: Time vs. Data

You must strip away the jargon. Explain it to the Board like this:

RPO (Recovery Point Objective) = "How much data can we afford to lose?"

If we crash at 4:00 PM, and our last backup was at 12:00 PM, we have lost 4 hours of data.

- Question to CEO: "Are you willing to re-enter 4 hours of orders manually? Or do you need the data to be live up to the last second?"

RTO (Recovery Time Objective) = "How long can we be dead?"

From the moment the server crashes, how many minutes/hours can pass before the "Buy" button works again?

- Question to CEO: "Does a 4-hour outage kill the company, or is it just an annoyance?"

2. The Cost Curve: The Price of Zero

The CEO's natural instinct is to say: "I want zero data loss and zero downtime."

Your answer is: "We can do that. It costs $50,000 a month."

This is the Asymptotic Cost of Availability.

- 99% Availability (RPO 24h / RTO 24h): Cheap. A nightly script. Cost: $100/mo.

- 99.9% Availability (RPO 1h / RTO 4h): Moderate. Database replication. Cost: $1,000/mo.

- 99.999% Availability (RPO 0s / RTO 0s): Expensive. Multi-region Active-Active clusters with real-time sync. Cost: $50,000/mo.

You must present Disaster Recovery as a Menu, not a binary switch.

3. The Strategy: The Tiered Menu

Don't treat all data equally. A "One Size Fits All" DR strategy is either too risky (for payments) or too expensive (for logs).

Present this table to your Executive Team:

Table 1: The Disaster Recovery Service Levels

| Tier | Workload | RPO (Data Loss) | RTO (Downtime) | Architecture | Cost |

| Platinum | Payments / Orders | ~0 Seconds | < 5 Mins | Multi-AZ, Auto-failover RDS, Hot Standby. | $$$$ |

| Gold | User Profiles / Inventory | 15 Mins | 1 Hour | Read Replicas, frequent snapshots. | $$ |

| Silver | Analytics / Reporting | 24 Hours | 48 Hours | Nightly S3 Dumps. Restore on demand. | $ |

| Bronze | Dev / Staging | Best Effort | 1 Week | Infrastructure as Code (Rebuild from scratch). | $0 |

When you frame it this way, the CEO will quickly decide that the "Marketing Blog" does not need Platinum-tier protection. You just saved the company money while clarifying the risk.

4. The Trap: The "Restore" Test

Having a backup is meaningless. Restoring is the only thing that counts.

Schrödinger’s Backup states: "The condition of any backup is unknown until a restore is attempted."

I have seen companies with "perfect" backups fail during a disaster because:

- The encryption key for the backup was on the server that crashed.

- The backup file was corrupted 6 months ago, and no one checked.

- The restore process took 18 hours to download the file (violating the 4-hour RTO).

The Executive Protocol:

- Mandate a Quarterly Fire Drill.

- Actually restore the production database to a staging environment.

- Time it. If it takes 6 hours, and your RTO is 4 hours, you are failing compliance. Report this to the Board immediately as a risk to be mitigated.

Summary

Disaster Recovery is not a technical problem; it is an Insurance Policy.

Your job is to act as the Insurance Broker.

- Define the terms (RTO/RPO).

- Quote the premiums (Cost of Architecture).

- Let the Business decide the coverage.

If the business chooses "Silver Tier" coverage and the site goes down for 24 hours, you are not incompetent; you are compliant with the agreed policy. That is the difference between being fired and being a strategic partner.

No spam, no sharing to third party. Only you and me.

Member discussion