"Buy vs. Build" Matrix: A Decision Framework for CEOs

In every Board meeting regarding a new technology initiative, the same question eventually arises: "Why are we paying Salesforce $200k a year? Can't our engineering team just build a CRM over the weekend?"

This question usually stems from a dangerous misconception: that engineering time is free (because they are already on payroll) and vendor costs are expensive (because they show up on an invoice).

This is the "Builder's Trap." It is the tendency of technology companies to undervalue the Total Cost of Ownership (TCO) of internal software and overvalue the "strategic control" of owning the code.

Building your own software is often an ego trip, not a business strategy. Unless you are selling the software, the code you write is a liability, not an asset.

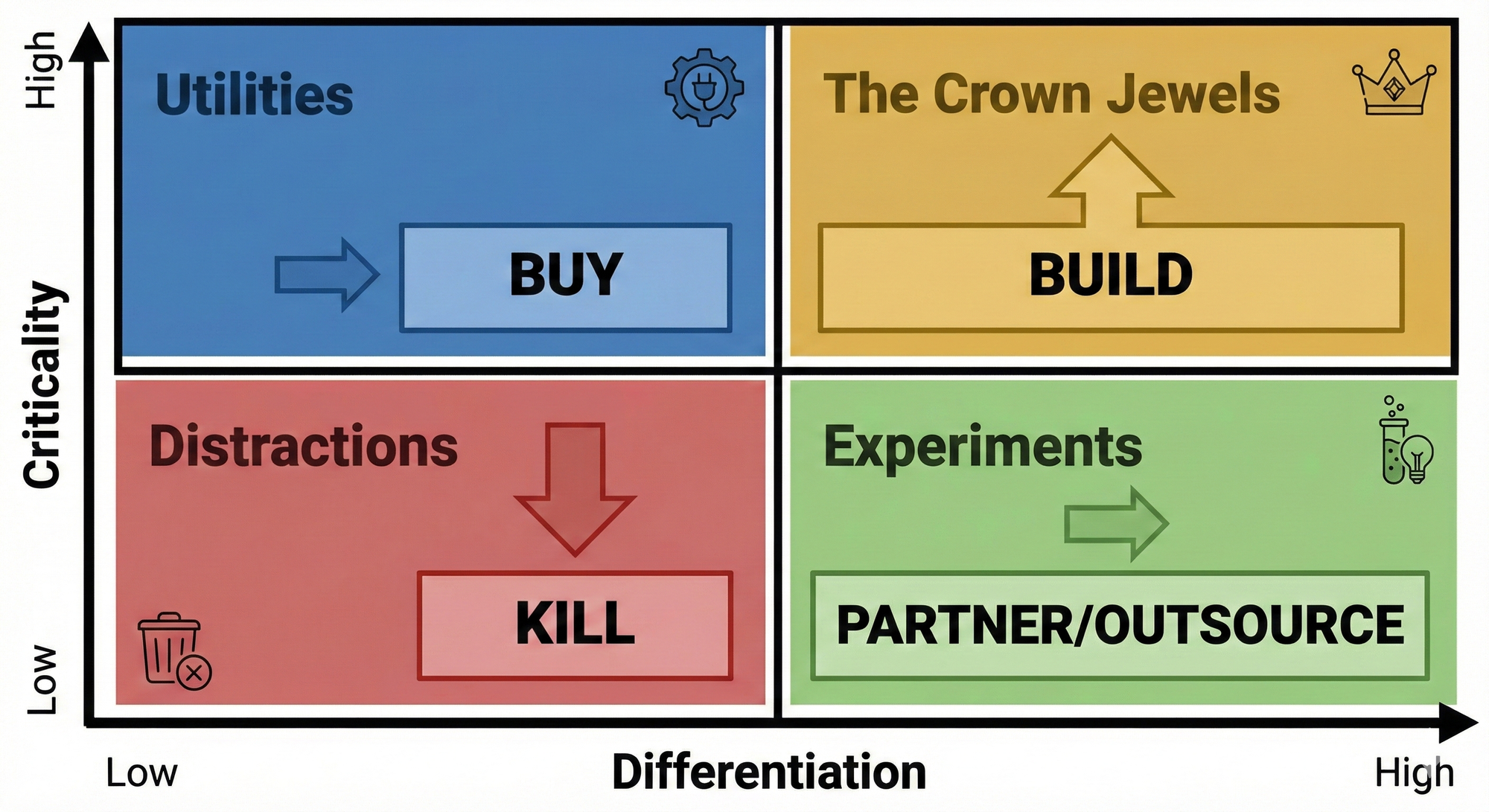

Here is the decision matrix I use to determine when to swipe the credit card and when to open the IDE.

1. The Psychology: "Not Invented Here" Syndrome

Why do CTOs and Engineers love to build? Because it’s fun. Building a custom analytics engine is intellectually stimulating. Configuring Google Analytics is boring.

However, in business, boring is profitable.

When you choose to Build, you are not just paying for the initial development. You are signing a contract to maintain that code forever.

- You must patch the security vulnerabilities.

- You must update the libraries.

- You must onboard new hires to the custom codebase.

The 10x Rule: For every $1 you spend building a tool, you will spend $10 maintaining it over its lifecycle. If you "Build" to save on a $50k SaaS license, you usually end up spending $500k in engineering salary allocation over 5 years.

2. The Decision Framework: The "Core vs. Context" Matrix

To remove emotion from the decision, we map every potential software project on a 2x2 matrix based on Differentiation (Does this make us unique?) and Criticality (Do we die without it?).

Quadrant 1: The Crown Jewels (High Criticality / High Differentiation)

This is your secret sauce. This is the code that generates your revenue or gives you a moat against competitors.

- Example: Uber's matching algorithm. Netflix's recommendation engine.

- Strategy: BUILD. Own this code. Never outsource it. This is your company's valuation.

Quadrant 2: The Utilities (High Criticality / Low Differentiation)

These are systems you need to survive, but having a "better" version doesn't get you more customers.

- Example: A CRM, an Email Server, an Accounting System, a Payroll engine.

- Strategy: BUY. Having a "custom" payroll system gives you zero competitive advantage. It just gives you audit risks. Buy Salesforce, buy NetSuite, buy Workday. Do not be a hero.

Quadrant 3: The Experiments (Low Criticality / High Differentiation)

These are innovative ideas that might become Crown Jewels, but aren't essential yet.

- Example: An internal AI chatbot for HR support.

- Strategy: PARTNER / LOW-CODE. Don't commit a full engineering team. Use a Low-Code platform or an agency to prototype. If it becomes critical, move it to Quadrant 1.

Quadrant 4: The Distractions (Low/Low)

- Example: An internal social network for employees.

- Strategy: KILL. Why are we discussing this? Use Slack.

3. The Financial Reality: CAPEX vs. OPEX

CFOs often prefer Building because they can capitalize the development costs (CAPEX), making the P&L look better in the short term. SaaS fees are OPEX, which hits EBITDA immediately.

This is an accounting illusion that hides the Maintenance Tail.

Table 1: The Hidden Cost of "Building"

| Cost Category | BUY (SaaS) | BUILD (Internal) |

| Upfront Cost | Low (Implementation Fee) | High (Months of Engineering Salary) |

| Time to Value | Weeks | Months/Years |

| Maintenance | $0 (Included in sub) | High (Server patches, bug fixes, upgrades) |

| Scalability | Instant (Pay for more seats) | Slow (Refactoring required) |

| Risk | Vendor Lock-in | "Bus Factor" (Key engineer quits) |

The Verdict: Buying is Deflationary (software gets better/cheaper over time). Building is Inflationary (technical debt accumulates over time).

4. The Exit Strategy: Dealing with Lock-In

The biggest argument against Buying is Vendor Lock-In. "What if Salesforce raises prices by 30%?"

This is a valid risk. But compare it to Technical Debt Lock-In.

If you build a custom CRM, and the Lead Engineer leaves the company, you are locked into a system that no one knows how to fix.

- Vendor Lock-In is solved by money. (You pay the ransom or pay to migrate).

- Tech Debt Lock-In is solved by time. (You stop all features for 6 months to rewrite).

For a growing company, Time is more expensive than Money.

Summary

The job of a technology leader is not to write code; it is to solve business problems.

- Audit your Roadmap: Look at every project proposed for Q3.

- Apply the Matrix: Is this project "Core" (Differentiating)?

- Ruthlessly Buy: If it's a utility (Auth, Billing, Search, Messaging), buy it. Use Auth0. Use Stripe. Use Algolia. Use Twilio.

Save your brilliance for the code that actually makes your customers buy your product.

No spam, no sharing to third party. Only you and me.

Member discussion